To 4.5%of Softbank G and German Telecom."Roman and abacus" seen in the Arm Nvidia Strategy

This is KNN Paul Kanda.

The "Arm Nvidia Strategy", which will become a major shareholder of the acquisition, is coming up again.

Softbank G's strange thing was the "Arm Nbidia Strategy".

Not only the tax alchemy scheme, but also the sale of the arm as a business sale, it has been held up to Nvidia's initiative.

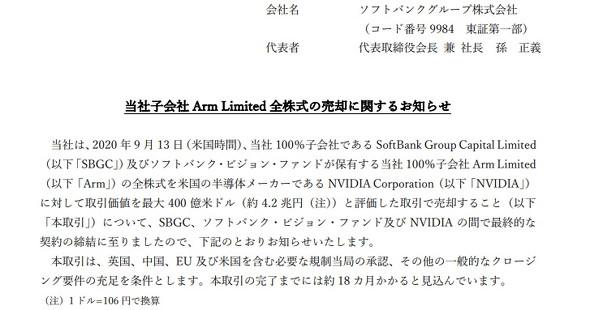

2016年9月に310億ドル(3.1兆円)の高値で買収した『アーム』の75%(2.3兆円)は株主配当として、キャッシュを手に入れ『ソフトバンク・ビジョンファンド』へ譲渡し、4000億円の申告修正。

その後、『ソフトバンクビジョンファンド』が『エヌビディア』と株式交換で『アーム』を4.2兆円分で売却したのだ。

取引完了後のエヌビディア株の保有比率は8.1%となり筆頭株主となった。

現在エヌビディアの時価総額は5,647億ドル(56.47兆円)で、8.1%での価値は、457.4億ドル(4.574兆円)となる。

There is a shareholder dividend of 2.3 trillion yen from the arm bought for 3.1 trillion yen, sold for 4.2 trillion yen, and its value is 4.5 trillion yen.

Even with simple calculation ...

2.3 trillion yen + 4.5 trillion yen -3.1 trillion yen = 3.7 trillion yen

The arithmetic calculation is established.

Moreover, Nbidia and arms are in their hands, and 3.7 trillion yen of fluid assets are in their hands.

notebook-laptop

notebook-laptop