What are the 5 risks you should be aware of when opening a securities account? What should be done?

While the US stock market continues to perform well and the number of brokerage account openings is increasing, some people may feel that opening an account is risky. Here, we will explain five specific risks and answer common questions about opening an account and investing.

Related articles- Which securities company do you recommend for NISA? A thorough explanation of how to choose a brand!

- What is the biggest disadvantage of NISA? A thorough explanation of the points you need to know to avoid failure!

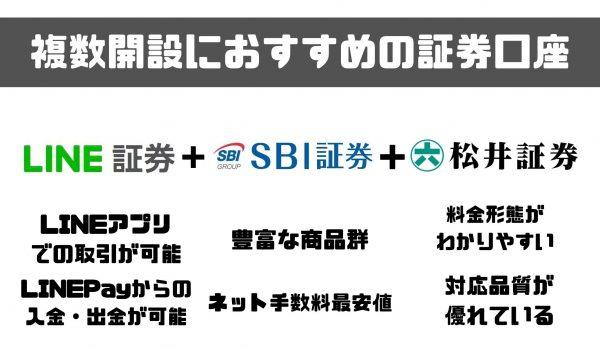

- Should I open multiple brokerage accounts? Introducing recommended combinations!

Five risks to be aware of when opening an online brokerage account

What kind of risks should I be aware of when opening an online brokerage account? ?

You should know five risks, including the risk of asset loss due to investment, security risk, and human error.

The five risks presented here are not difficult. Knowing the contents of the risk leads to damage prevention.

The prices of financial products fluctuate daily. The risk of financial products means the range of up and down fluctuations in price movements. High risk includes the possibility of generating large profits as well as large losses.

It is necessary to understand the basic knowledge of investment products for risk countermeasures of financial products. When opening an online securities account, be sure to understand the risks of the financial products you plan to trade.

In general, the risk increases in the order of deposits, bonds, investment trusts, and stocks. High-risk products tend to have high returns, and low-risk products tend to have low returns.

At Net Securities, you use your ID and password to log in to the site and trade. Using a computer or smartphone to log in to a securities firm's website entails security risks such as information leaks and unauthorized access.

If your password is guessed and you are logged in illegally, you may suffer an unexpected loss.

In September 2020, fraudulent withdrawals from online securities customer accounts were reported and became a hot topic. Security risks must always be addressed in order to avoid damage. Source: Nihon Keizai Shimbun (September 16, 2020)

On-line securities make investment decisions by examining information such as account opening and trading on their own. There is a risk of opportunity loss due to lack of knowledge, such as when you cannot get advice from a professional.

For example, let's say you open an account with an online brokerage to invest in foreign stocks. After opening an account, if you find that you cannot trade foreign stocks with that online securities company, you will lose the opportunity to trade foreign stocks until you open a new account with an online securities company that allows you to trade foreign stocks.

It is essential to collect information in advance considering the risk of opportunity loss when using Internet securities.

Because online brokerages allow you to place an order yourself using a computer or smartphone, any loss caused by human error (wrong order) is your responsibility.

Recognize that humans make mistakes and try to stay calm when ordering.

You may not be able to place an order due to a malfunction of the communication line or the device such as the PC or smartphone you are trading with. System risks such as communication lines and devices should also be taken into consideration.

For example, because you can't place an order, your stop loss may be delayed and your loss may be large.

Fixing the loss by selling the stock when the stock price is lower than when you bought it and there is a loss.

The risk of communication lines can be countered by preparing multiple lines such as optical lines and mobile lines. For device risk countermeasures, it is considered effective to prepare multiple devices such as personal computers and smartphones.

Four Security Risks in Internet Securities and Countermeasures

I'm worried about the security of Internet securities.

Security measures are not difficult when using Internet securities. Understand the four risks such as "leakage of personal information" and "fraudulent transactions" and take appropriate countermeasures.

Take measures against the following four security risks in order to use online securities safely.

- Leakage of personal information

- Unauthorized transaction

- Unauthorized withdrawal

- Virus infection

Online Consider countermeasures against the risk of personal information being leaked from services other than securities.

Securities companies take strong security measures to keep customers' funds and assets. However, if users reuse passwords, the risk of unauthorized login increases.

Login information may be leaked from services of other companies. If you use the same password for multiple services, there is a risk that a password leaked from one company's service may be used to log in to another company's service.

As a general rule, passwords should not be reused, and it is recommended to use different passwords for each service.

However, if you use different passwords for each service, password management becomes a problem. To manage many passwords, you can either write them down on paper or use a password management tool.

In the case of paper management, it is important to record user IDs and passwords on separate papers and store them separately in a place that is out of sight.

Password management tools allow you to easily manage multiple passwords by simply remembering one master password. The point to note is that there is a risk of information leakage from tools with unreliable services, so choose a highly reliable tool.

Password management example

| Password management method | Points |

|---|---|

| Paper management | ・People・Record user ID and password on separate paper and store them separately |

| Password management tool | You just have to memorize the password to start the tool ・The "reliability" of the tool is important |

*Created by the author with reference to the JPCERT/CC official website

Passwords should be strong. Simple passwords can be easily guessed.

For example, if you use your date of birth as your password, the chances of your password being cracked by leaking your date of birth increase. Services with high security are generally designed so that simple passwords cannot be set.

A strong password is one that satisfies the following conditions, for example:

An example of a strong password

| Password items | Recommended conditions |

|---|---|

| Number of characters | Make it longer ( 12 or more characters recommended) |

| Type of characters | Include uppercase and lowercase letters, numbers, and symbols |

| Character patterns | Avoid easy-to-guess dates of birth and keyboard layout |

*JPCERT/CC official website Created by the author with reference to

If a device such as a smartphone or computer is obtained by a malicious third party due to theft, the risk of accessing your online brokerage account increases.

Biometric authentication such as face authentication and fingerprint authentication is effective in preventing malicious third parties from operating the device. Using biometric authentication can be expected to reduce the risk of others using the device.

If you can use two-step authentication (two-factor authentication) when logging in, even if your user ID and password are leaked, you cannot easily log in illegally.

The two-factor authentication for PCs is often used to log in by entering the one-time password or authentication code sent to the registered email address.

Some smartphones require biometric authentication such as face authentication or fingerprint authentication every time the application is started.

If two-factor authentication is available for login, we recommend enabling it.

If your smartphone or computer that uses online brokerage is lost or stolen, change your password so that you cannot log in easily. Depending on the securities company, it is also possible to change the login ID.

Some internet brokerages allow you to restrict logins. For example, SBI SECURITIES can ask the support desk to prevent users from logging into smartphone sites and apps.

Respond quickly when a device is lost and prevent unauthorized operation.

Illegal trading may occur if a third party logs into an online brokerage account.

It is common to be asked to enter a transaction password or PIN when trading in online securities.

If your login password is leaked and you are logged in illegally, you may be involved in illegal transactions if your login password and transaction password are the same.

Do not set a simple password for your transaction password, just like your login password. Set a highly secure transaction password by paying attention to the number of characters, the type of characters, and avoiding patterns that are easy to guess.

Even if your transaction password and login password are different, if you save your transaction password on a device such as a smartphone, you are more likely to fall victim to unauthorized transactions if your device is lost. We recommend that you do not store transaction passwords on your device.

For securities companies that require you to enter a PIN when trading, set a PIN that is difficult to guess. Easy-to-guess PINs, such as birth dates or the same number, increase the possibility of authentication being broken by a malicious third party.

Regularly changing your login password and transaction password will increase the possibility of preventing unauthorized transactions by a third party. Even if the login information and transaction password are leaked, damage by a malicious third party may not be done immediately.

If you change your password regularly, a third party will not be able to make unauthorized transactions with the password that was leaked before you changed your password.

Regularly changing your password has the effect of increasing security, but if you feel that changing your password is a hassle and set a simple password, the risk increases.

Even if you change your password regularly, don't use simple passwords and set a highly secure password.

To prevent funds from your brokerage account from being withdrawn to third parties, you should take three measures:

When using two-step verification (two-factor authentication), if you are notified of your PIN by e-mail or SMS, be careful when selecting a device such as a smartphone or computer to be registered as a notification destination.

When the PIN code is notified to the device that uses the Internet securities, the PIN code can be confirmed on that device, so the two-step verification is broken.

If you are notified of a PIN code, etc., you can increase the security level by setting a different device as the notification destination than the device that uses the online securities.

When a malicious third party steals funds from a brokerage account, the registered withdrawal account will be changed before withdrawal.

If the withdrawal account cannot be easily changed, it will help prevent unauthorized withdrawals by third parties. It is a good idea to choose a securities company that requires identification documents to change the withdrawal account.

For example, SBI Securities and Monex Securities require a written application to change the withdrawal account (as of January 4, 2022). If you need to attach an identity verification document with a written application, you cannot easily change the withdrawal account.

Usually, we don't change the withdrawal destination account frequently, so it seems that there are few cases where the change procedure in writing will cause inconvenience. When choosing a securities company, it is a good idea to check how to change the withdrawal account.

If you save your login ID, login password, and transaction password on a device such as a smartphone or computer, you can save the trouble of entering passwords when logging in or making transactions.

However, if a device that stores passwords etc. falls into the hands of a malicious third party and the device is unlocked (locked), they can easily allow access to the brokerage account.

If you do not store passwords and other information on your device, you will not be able to withdraw easily even if your device falls into the hands of a third party. Withdrawals require three steps of authentication: device authentication, brokerage account login authentication, and transaction authentication for withdrawals. If the login authentication to the securities account is two-step, a total of four-step authentication is required, which increases the difficulty of withdrawal.

If you don't save your login ID and password on your device, every time you log in or make a transaction, it will take more time, but the security level will increase.

If your smartphone or computer is infected with a virus, the risk of your login ID and password being leaked increases.

Installing security software is considered an effective security measure. We recommend installing security software especially for Android devices and Windows PCs. Many of the viruses that target smartphones are said to target Android.

Various security software is provided for Android. If you have an Android device, we recommend installing "trusted" security software. For example, ESET, Norton, Kaspersky, etc. are known as major security software.

Unreliable security software may increase the risk by installing software.

Windows 10 and Windows 11 include Windows Security like Windows Defender by default. There are opinions that Windows security alone is sufficient for Windows, and that third-party security software is preferable.

If you are familiar with Windows security, standard Windows security might be enough for you.

For those who are not familiar with Windows security, paid security software may be more secure in terms of security and support. Normally, we recommend installing paid security software such as ESET or Norton.

There is an opinion that security software is unnecessary for iPhone, but considering the security of web browsing and Wi-Fi, it is considered desirable to install security software.

iOS, Android OS, Windows, and other operating systems are updated to fix any vulnerabilities (defects or flaws).

Therefore, when you receive an OS upgrade notification, apply the update to the latest OS.

Vulnerabilities will not be fixed once support for the OS ends. In particular, Android tends to have a short period until support ends. Consider purchasing a new device after OS support ends.

Applications and software created with malicious intent carry risks such as virus infection when installed.

Be careful not to install any free Windows software unless you trust it. When installing, make a habit of limiting it to software whose reliability can be confirmed.

Installing apps on the iPhone is considered worry-free. This is because app downloads are restricted to the App Store and rigorous vetting eliminates malicious apps. However, just to be sure, it is also important to check user reviews to make sure the app is trustworthy.

When installing Android apps, be careful not to install apps whose creator is unknown. Apps of unknown authors may have been created with malicious intent. Also, check the user reviews of the app to make sure it is trustworthy.

Security-friendly smartphone apps for stock trading are shown in the table below.

| App name (brokerage company name) | Biometric login | Features |

|---|---|---|

| iSPEED (Rakuten Securities) | Available | ・Various functions equivalent to PC tools・15 types of customizable charts |

| Monex Securities App (Monex Securities) | Available | ・Analysis of asset trends and constituent assets possible・Easy to use with customizable menus |

| GMO Click Stocks (GMO Click Securities) | Available | ・Confirm stock charts, news, etc. on one screen・PC-level chart function | < /tr>

* Created by the author with reference to the official websites of Rakuten Securities, Monex Securities, and GMO Click Securities

These apps support biometric logins and have great user reviews.

What are the risks of stock investment that you should understand before opening a securities account?

What are the risks of investing in stocks?

There are three main risks associated with domestic stocks, including the risk of loss due to stock price fluctuations and the risk of bankruptcy of investees.

If you understand the three risks, it will lead to risk control of stock investment.

Possibility of loss or profit due to fluctuations in stock prices rising or falling.

Stock price volatility risk refers to the range of fluctuations in price movements, which includes not only price declines but also price rises. Factors that cause stock prices to fluctuate include corporate performance, supply and demand in the stock market, the economy, the economy, and politics.

The possibility of bankruptcy due to financial difficulties or poor management of a company.

When a company goes bankrupt, stock prices tend to drop significantly. In order to reduce credit risk, it is necessary to check and analyze the performance and financial conditions of the companies in which we invest.

Possibility of not being able to trade due to low trading. In a state of high liquidity risk, there is a high possibility that you will not be able to buy when you want to buy, and you will not be able to sell when you want to.

For example, stocks cannot be traded on the market if the listing is delisted due to a company's fraudulent financial results. Therefore, when the delisting is announced, there is a flood of sell orders, and even if you want to sell it, there is a possibility that you will not find a buyer.

In addition, liquidity risk includes the possibility of being unable to trade at the desired price due to low trading volume, and being forced to trade at a disadvantageous price. For example, if you want to sell a stock but there are few buy orders and the trade closes at a lower price than you expected.

To reduce liquidity risk, choose stocks with high volume and trading value.

"Diversified investment" and "long-term investment" are effective measures against the risk of stock investment

How can you manage the risk of stock investment?

Among the aforementioned stock investment risks, price fluctuation risks have a wide range of factors and are not easy to deal with. However, a combination of several measures can be expected to reduce the risk.

The key points are "diversified investment" and "long-term investment". In addition, diversified investment can be classified into three types: "stock diversification", "geographic diversification" and "time diversification".

An investment method that aims to reduce risk and obtain returns by dividing the "brand", "region", and "time" to invest in.

Stocks of various companies are traded on the market. There are a wide variety of stocks, from stocks with similar price movements to stocks with different price movements.

You can expect risk reduction by investing in a combination of stocks with dissimilar price movements. Stocks in the same industry tend to have similar price movements, so combining stocks in different industries is effective.

Price movements may vary depending on the country where the stock is listed. Stock prices are affected by the economy and politics of a country (region), so investing in a combination of stocks from multiple countries helps reduce risk.

For example, if you invest in diversified stocks such as Japan, the United States, the United Kingdom, and China, even if a problem occurs in a particular country and the stock price fluctuates greatly, the stock price of other countries may have little impact.

In time diversification investment, diversification of the timing of investment leads to risk reduction.

If you invest all at once, the risk increases if the stock price fluctuates significantly after the investment. If you spread out your investment over time, you can expect investment prices to level out over different periods and reduce risk.

Buying assets on a regular basis is an investment method that allows you to diversify your time.

An investment method in which financial assets are held for a long period of time for asset building.

In short-term trading, even small price movements result in daily profits and losses. On the other hand, long-term investments such as 10 years or more tend to have small short-term price fluctuations, so long-term investment reduces risk.

In addition, stock prices tend to rise as companies grow. If a company grows, even if there is a temporary drop in stock price in the short term, you can expect a rise in stock price in the long term. This means that long-term investments in growth companies can be expected to reduce risk.

Of course, long-term investment in companies that cannot be expected to grow may not be expected to reduce risk due to sluggish stock prices.

In long-term investment, it is important to select stocks to invest in.

Products and services that can reduce investment risk

Are there any products or services that can be expected to reduce investment risk?

It is better to use products and services that are suitable for long-term investment. Specifically, there are ways to utilize investment trusts and government-backed tax exemption systems.

Investment trusts, NISA/iDeCo, and robo-advisors are products and systems suitable for investment beginners. Let's take a look at its features.

A financial product managed by a "fund manager" who is a professional in asset management with the aim of increasing assets by collecting funds collected from investors.

A type of investment trust that can be traded on the stock market.

Investment trusts can be expected to reduce risk by incorporating multiple assets into a diversified investment, but there is a risk of loss of principal.

A system in which trading profits, dividends and distributions obtained from investments are tax-exempt.

In addition to tax-exempt income earned from investments, a private pension system in which all contributions are tax-deductible and tax benefits are received at the time of receipt.

There are regular NISA (General NISA), Tsumitate NISA, and Junior NISA. General NISA and Mitate NISA are available for those aged 20 and over. General NISA can be invested in stocks and investment trusts, etc., and Tsumitate NISA can be invested only in investment trusts.

iDeCo can be invested in investment trusts and time deposits.

Here is a table that compares general NISA, Tsumitate NISA, and iDeCo.

Comparison of General NISA, Tsumitate NISA, and iDeCo

| General NISA | Sumitate NISA | iDeCo | |

|---|---|---|---|

| Up to 5 years | Up to 20 years | Until age 60 *1 | |

| Equity investment trusts, etc. | Some investment trusts, some ETFs | Investment trust time deposits, etc. | |

| Benefits | There are many tax-exempt income items | Tax-free income | When receiving full income deduction Tax incentives available |

| Disadvantages | Long-term investment is difficult | Limited products | Age 60 |

* Created by the author with reference to the Financial Services Agency NISA special website and iDeCo official website * 1 < Join from May 2022 until the age of 65 plan to be able

Regular NISA, Tsumitate NISA, and iDeCo can use reserve investment through regular purchases of investment trusts. A reserve investment can be expected to reduce risk through time diversification.

In particular, Tsumitate NISA can be used for up to 20 years, and iDeCo can be used for tax-free long-term investment up to the age of 60. In addition, investment products are investment trusts, so diversified investment can be expected. These two are systems that can be expected to reduce risk through long-term and diversified investment.

General NISA has a tax-free investment period of 5 years in principle, and it can be said that it is a system suitable for short- to medium-term investment.

A service that uses AI (artificial intelligence) to diagnose, advise, and manage investments.

Robo advisors can be divided into two types: “advice type” and “discretionary investment type”.

Comparison of Advice Type and Discretionary Investment Type

| Advice type (advice type) | Discretionary investment type (automated investment type) | |

|---|---|---|

| Features | Advice | Actual operation |

| Benefits | Many are free | You can even leave the product trading to us |

| Disadvantages | Trade the product yourself | < td>There is a fee|

| Service examples | Investment Trust Studio (Matsui Securities) SBI-Fund Robo (SBI Securities), etc. | < td>WealthNavi, SUSTEN, etc.

*See the official websites of Matsui Securities, SBI Securities, WealthNavi, and susten Capital Management. created by the author

The advice type advises asset allocation and products suitable for each investor. Based on the results of the advice, purchase financial products to invest in yourself.

Discretionary investment type proposes asset allocation and products suitable for each investor, and if you agree with it, we will entrust the actual operation.

Generally, the advice type is free, and the discretionary investment type is charged.

Top 5 recommended online brokers for opening a brokerage account!

I would like to choose an online securities company to open an account with. What points should I compare?

The main points to compare are whether the product you plan to trade is handled, whether there are many products handled (whether it is possible to select from various brands), and whether the fee is low. Also, if you want to invest in points, make sure that it corresponds to points that are easy to use.

When opening a brokerage account, it can be said that it is easy to use online securities with a fulfilling product lineup and cheap fees.

Introducing the characteristics of 5 recommended online securities companies.

- SBI Securities

- Rakuten Securities

- Matsui Securities

- au Kabucom Securities

- LINE Securities < /ol>(Image = quoted from SBI Securities)

- A popular online securities company with the highest number of brokerage accounts opened

- Top-level major online securities companies with a wide range of products

- Two common points (T points, Ponta points) ) can be accumulated and used

- High-performance trading tools can be used for free

- Rakuten Points (Rakuten Securities Points) can be accumulated and used

- By combining Rakuten Card and Rakuten Bank

- Over 100 years of track record and reliability

- Transactions up to 500,000 yen per day can be traded with no commission

- If you are 25 years old or younger, you can do it in Japan No stock transaction fees

- Security provided by Mitsubishi UFJ Financial Group

- The largest number of types of automated trading on the Internet

- You can purchase domestic stocks starting from 1 share, starting from 500 yen per month

- Margin trading commissions are free regardless of the contract price

- Ichikabu (shares less than one unit) can be invested from around several hundred yen per share < li>You can use LINE points "at the time of deposit" to invest points

- Register personal information

- Submit identity verification documents

- Receive account opening completion notification

- Start trading after logging in

- Reducing the risk of system failure

- Saving transaction fees

- Increase the odds of winning an IPO stock

SBI Securities is a leader among Internet securities in terms of product lineup and fees.

Basic information of SBI SECURITIES

| Number of accounts opened | Over 7.7 million accounts (as of September 2021)*1 | |

|---|---|---|

| Handling Products | Domestic stocks less than one unit (S shares) Foreign stock investment trust NISAiDeCo, etc. | |

| Domestic stocks | Spot transaction fees ( Tax included) | [Standard Plan] () indicates contract price 55 yen (up to 50,000 yen) 99 yen (up to 100,000 yen) 115 yen (up to 200,000 yen) 275 yen (up to 500,000 yen) ) [Active plan] 0 yen (up to a total of 1 million yen for a day) |

| Margin transaction fee (tax included) | [Standard plan] () indicates contract price 99 yen (up to 100,000 yen) 148 yen (up to 200,000 yen) 198 yen (up to 500,000 yen) 385 yen (more than 500,000 yen) [Active plan] 0 yen (1 day contract price) Up to 1 million yen in total) | |

| IPO performance (2021) | 122 stocks | |

| United States Stocks | Number of stocks handled | More than 5,000 stocks (as of December 29, 2021) |

| Transaction fee (tax included)< /th> | 0.495% of contract price Minimum fee: 0 USD Maximum fee: 22 USD | |

| Investment trusts | Number handled | Over 2,600 (as of December 22, 2021) |

| Point investment | T points Ponta points |

*Created by the author with reference to SBI SECURITIES official website, as of January 6, 2022*1

Introducing three features of SBI SECURITIES.

SBI SECURITIES is a popular online securities company with the highest number of securities accounts opened among domestic securities companies. Including SBI Neomobile Securities and SBI Neotrade Securities, the number of securities accounts has exceeded 7.7 million.

SBI SECURITIES has a rich product lineup. We handle over 5,000 US stocks and over 2,600 mutual funds.

In addition to stocks and investment trusts, we also handle many products such as bonds, FX, futures, CFDs, gold and silver, and our product lineup is top-level among major online securities.

The point system of securities companies makes it easier to transfer points to services of other companies if you can use common points, increasing convenience.

SBI SECURITIES supports two common points, T points and Ponta points, and you can set which points to accumulate. Both can be used to purchase mutual funds.

Click here to open an account with SBI Securities (Image = quoted from Rakuten Securities) It is a popular online securities company with more than 7 million accounts opened.Rakuten Securities Basic Information

| Number of accounts opened | Over 7 million accounts (as of December 2021) | |

|---|---|---|

| Products handled< /th> | Domestic stocks Foreign stock investment trust NISAiDeCo, etc. | |

| Domestic stocks | Spot transaction fee (tax included) | [Super discount course] () is contract price 55 yen (up to 50,000 yen) 99 yen (up to 100,000 yen) 115 yen (up to 200,000 yen) 275 yen (up to 500,000 yen) 0 yen (up to 1,000,000 yen total transaction price per day) |

| Margin transaction fee (tax included) | [Super discount course] () Execution price 99 yen (up to 100,000 yen) 148 yen (up to 200,000 yen) 198 yen (up to 500,000 yen) 385 yen (more than 500,000 yen) Up to 1 million yen) | |

| IPO results (2021) | 74 stocks | |

| US stocks | Number of stocks handled | More than 4,500 stocks |

| Transaction fee (tax included) | 0.495 of contract price %Minimum fee: 0 yen Maximum fee: US$22 | |

| Investment trusts | Number of transactions | Over 2,600 |

| Point Investment | Rakuten Point Rakuten Securities Point |

*See Rakuten Securities official website Created by the author as of January 6, 2022

Introducing three features of Rakuten Securities.

Rakuten Securities' "MARKETSPEED II" trading tool for PCs and "iSPEED" trading tool for smartphones have a reputation for their ease of use and can be used free of charge.

MARKETSPEED Ⅱ has a full range of "algo orders" that automatically place orders when registered conditions are met, so you can trade with confidence even if you cannot check the market during the day due to work or travel.

iSPEED is a simple and quick ordering app for iPhone and Android. With 15 chart customizations, you can easily analyze charts on your smartphone.

Rakuten points can be accumulated according to the amount held in investment trusts, etc., and can be used for point investment.

Rakuten points can be used for domestic stocks, US stocks, investment trusts, etc. One of the attractions of Rakuten Securities is the wide range of products eligible for point investment.

Rakuten Securities points can be saved and used instead of Rakuten points. Rakuten Securities points can be used to purchase investment trusts or redeem JMB miles for JAL. In addition, Rakuten Points and Rakuten Securities Points can be exchanged at a 1:1 ratio.

Rakuten Securities offers many advantages when used in conjunction with Rakuten Card and Rakuten Bank. You can earn Rakuten Points by accumulating investment trusts at Rakuten Securities with Rakuten Card credit payments.

By using the Rakuten Bank and Rakuten Securities account linking service "Money Bridge", there are benefits such as increasing the interest rate on ordinary deposits at Rakuten Bank to 0.10% per year (before tax), which is five times higher. This is a great service in today's world of ultra-low interest rates.

Click here to open a Rakuten Securities account.Basic information about Matsui Securities

| Number of accounts opened | More than 1.3 million accounts (as of the end of September 2021) | |

|---|---|---|

| Products handled< /th> | Domestic stock investment trust NISAiDeCo, etc. | |

| Domestic equities | Spot transaction fee (tax included) | 0 yen (Up to 500,000 yen total transaction value per day)*1 |

| Margin transaction fee (tax included) | 0 yen (total transaction value per day) Up to 500,000 yen)*1 | |

| IPO results (2021) | 56 stocks | |

| US stocks | Number of stocks handled | - |

| Transaction fee (tax included) | - | |

| Investment trusts | Number of transactions | Over 1500 |

| Point investment | Matsui Securities Points |

* Created by the author with reference to Matsui Securities official website, as of January 6, 2022 *1<25 Fees are free for children under the age of 12 regardless of contract price

Introducing three features of Matsui Securities.

Matsui Securities is a long-established securities company founded in 1918 with a history of over 100 years. In 1998, it started full-scale Internet trading for the first time in Japan, and is also a long-established Internet securities store.

Matsui Securities is a trustworthy securities company with a track record as a securities company, sound financial content and a full support system.

Matsui Securities offers good trading fees for domestic stocks. You can trade up to 500,000 yen in total daily contract value for both spot trading and margin trading with no fees.

There is no need to choose a fee course or plan, and the advantage is that the fee is easy to understand with a simple fee system.

People under the age of 25 get even better trading fees for domestic stocks. Both spot trading and margin trading can be traded as many times as you like with no fees regardless of the contracted amount.

If you are 25 years old or younger, Matsui Securities is especially recommended because there are no domestic stock transaction fees.

Click here to open an account with Matsui Securities (Image = quoted from au Kabucom Securities)au Kabucom Securities is an online brokerage company of the Mitsubishi UFJ Financial Group, and aims to integrate telecommunications and finance in partnership with KDDI.

Basic information of au Kabucom Securities

| Number of accounts opened | More than 1.3 million accounts (as of December 2021) | |

|---|---|---|

| Products handled< /th> | Domestic stocks less than one unit (petit stocks) investment trust NISAiDeCo, etc. | |

| Domestic stocks | Spot transaction fee (tax included) | [One-shot fee course] () indicates contract price 55 yen (up to 50,000 yen) 99 yen (up to 100,000 yen) 115 yen (up to 200,000 yen) 275 yen (up to 500,000 yen) [ 1 day fixed fee course] 0 yen (up to 1 million yen total transaction price per day) |

| Margin transaction fee (tax included) | [One shot Fee course] In () is contract price 99 yen (up to 100,000 yen) 148 yen (up to 200,000 yen) 198 yen (up to 500,000 yen) 385 yen (more than 500,000 yen) [One-day fixed fee course] 0 yen (Up to 1,000,000 yen in total trade value per day) | |

| IPO results (2021) | 42 stocks | US stocks | Number of stocks handled | - |

| Transaction fee (tax included) | - | |

| Investment trusts | Number handled | Over 1,500 |

| Point investment | Ponta points |

* Created by the author with reference to au Kabucom Securities official website, January 6, 2022 point in time

Introducing three features of au Kabucom Securities.

au Kabucom Securities is an online securities company of the Mitsubishi UFJ Financial Group, which owns top-class domestic companies such as banks, securities companies, and asset management companies. , you can trade financial instruments with confidence.

As a preparation for system failures, we have taken measures in the unlikely event of a disaster, such as setting up a site dedicated to disasters (BCP site) in Fukuoka.

Au Kabucom Securities is a pioneer in automated trading.

The order is executed when the conditions are met. A stop loss order is also a type of automated trading.

The types of automated trading available at au Kabucom Securities are the largest among major online securities. With automated trading, you can fine-tune your risk.

If you use petit stocks (shares less than one unit), you can purchase domestic stocks from 1 share, and you can become a shareholder from around a few hundred yen.

Petit stock accumulation service "Premium Reserve (Petit stock)" allows you to accumulate domestic stocks from 500 yen per month. In addition, there is no purchase fee for premium reserves (petit stocks), so you can save money at a great price.

Click here to open an au Kabucom Securities account.Basic information about LINE Securities

| Number of accounts opened | Over 1 million accounts (as of the end of October 2021) | |

|---|---|---|

| Products handled< /th> | Domestic stocks less than one unit (Ichikabu) investment trusts, etc. | |

| Domestic stocks | Spot transaction fees (tax included) | >() indicates contract price 55 yen (up to 50,000 yen) 99 yen (up to 100,000 yen) 115 yen (up to 200,000 yen) 275 yen (up to 500,000 yen) |

| Margin transaction fee (tax included) | 0 yen | |

| IPO performance (2021) | 11 stocks | |

| US stocks | Number of stocks handled | - |

| Transaction fee (tax included) | - | |

| Investment trusts | Number of transactions | 32 | < /tr>

| Point investment | LINE points |

* Created by the author with reference to LINE Securities official website

Introducing three features of LINE Securities.

Margin trading of domestic stocks can be bought and sold without commission. Even if the contract price is high, the commission is free no matter how many times you trade.

I'm worried that the interest rate and stock lending fee will be high if the margin transaction fee is free, but the "interest rate" when buying and the "stock lending fee" when selling are about the same as SBI Securities and Rakuten Securities. is set low to

Comparison of interest rates and stock lending fees

| LINE Securities | SBI Securities | Rakuten Securities | |

|---|---|---|---|

| Interest Rate (Buy) | 2.80% | 2.80% | 2.80% |

| Stock lending Fee (selling) | 1.15% | 1.15% | 1.10% |

* Quoted from LINE Securities official website

If you use margin trading, LINE Securities is a particularly recommended online securities.

You can trade domestic stocks in units of 1 share of "Ichikabu", which is a fractional share. If the stock price is cheap, you can become a shareholder with a few hundred yen.

Many of the shares of less than one unit of major online securities do not support real-time trading, but "Ichikabu" is capable of real-time trading, so even shares of less than one unit can be traded without missing the timing.

With LINE Securities, you can use your LINE points to invest in things like Ichikabu.

LINE Securities point investment differs from other companies. In many online securities point investments, points to be used when purchasing financial products are specified, whereas in line securities point investment, points can be used at the time of deposit and the amount of deposit can be increased.

LINE Securities is characterized by the ability to use LINE points for all product transactions.

Click here to open a LINE Securities accountExplanation of how to open an online securities account in 4 steps

What steps are required to open an online securities account?

The general flow is to register personal information on the application page, submit identity verification documents, receive notification of completion of opening an account, deposit after logging in and start trading. The procedure may differ depending on the online securities, so please check the details on each company's official website.

I will explain how to open an account in 4 steps.

Access the account opening application page and enter the required information such as your email address, name, and address.

As a countermeasure against the risk of information leakage, be careful to register your personal information after confirming that the application page is the official page of the securities company.

Depending on the online brokerage, a verification code may be sent to your e-mail address, etc., and verification may be required.

My number registration and identity verification are required to open a securities account. You can use your My Number card or notification card to register your My Number. You can use your driver's license or passport to verify your identity.

In general, you can choose to upload a photo taken with a smartphone or scanned data, or send a copy by mail.

Once your account is opened, you will receive an account opening completion notice. It is common to choose the receipt method by e-mail or mail.

If you receive a notice by e-mail, you will receive information to access Net Securities (password setting page, etc.).

Check the contents of the email and set the password.

If you receive a notice by mail, you will receive information for accessing Net Securities (user ID, temporary password, etc.).

Once you receive the document, check its contents.

From the Net Securities login screen, enter your user ID and login password to log in.

Once logged in, make a deposit to trade financial instruments. Many online brokerages accept multiple deposit methods, such as online banking and bank transfers. Once you have made a deposit, you can start trading.

By opening multiple securities accounts, you can get benefits such as risk reduction

Is it effective to reduce risk by opening securities accounts with multiple companies?

This will reduce some of the risks. For example, if you are unable to trade due to an online brokerage system failure, you may be able to trade with other securities companies if you have multiple brokerage accounts.

In addition to reducing the risk of system failure, the benefits of opening multiple accounts include "saving transaction fees" and "increasing the probability of winning an IPO".

Multiple If you have an account with a securities company, you can trade with other companies in the event of trouble with a certain securities company. For example, if the stock you want to buy cannot be traded due to system trouble on Securities A, you can buy it on another Securities B.

If you want to sell stocks held in Securities A and cannot sell them due to system troubles in Securities A, you can deal with the risk of stock prices falling by short selling margin trading in Securities B.

You can save on transaction fees by using multiple brokerage accounts. The table below shows domestic stock trading that can be used free of commission for the above-mentioned five online securities companies.

Domestic stock trading that can be used free of charge from 5 recommended online securities companies

| Brokerage Company Name | Commission Free Trading |

|---|---|

| SBI Securities | Spot trading: Up to 1 million yen per day Margin trading (system credit): Up to 1 million yen per day Margin trading (general credit): Up to 1 million yen per day (up to 3 million yen in total) |

| Rakuten Securities | Total of spot trading and margin trading: Up to 1 million yen per day |

| au Kabucom Securities | Total spot and margin transactions: up to 1 million yen per day |

| Matsui Securities | Total spot and margin transactions: 1 Up to 500,000 yen per day |

| LINE Securities | Margin trading: All |

* Created by the author referring to the official websites of SBI Securities, Rakuten Securities, au Kabucom Securities, Matsui Securities, and LINE Securities, as of January 7, 2022

If you use these 5 brokerage accounts together, you can trade spot transactions up to a total of 3.5 million yen per day, and margin transactions with no fees.

To buy IPO stock before it goes public, you must have the right to buy. A common way to qualify is to apply for an IPO and win a lottery.

Applying from multiple brokerage accounts may increase your odds of winning the lottery. The table below summarizes the characteristics of the IPOs of the five Internet securities companies mentioned above.

Features of IPO of 5 recommended online securities companies

| Brokerage Company Name | Number of IPO Transactions (Results in 2021) | Characteristics of IPO |

|---|---|---|

| SBI SECURITIES | Very many (122 companies) | Lottery advantage with IPO point system |

| Rakuten Securities | Many (74 companies) | If you apply for a large number of shares, the lottery will be advantageous |

| au Kabucom Securities | Many (42 companies) | One person, one vote equal lottery |

| Matsui Securities | Many (56 companies) | No deposit required at lottery |

| LINE Securities | Not many (11 companies) | Purchase of IPO No fees |

* Created by the author referring to the official websites of SBI Securities, Rakuten Securities, au Kabucom Securities, Matsui Securities, and LINE Securities, January 2022 As of the 7th of the month

Securities companies with a large number of transactions can apply for many IPO stocks, but on the other hand, there is a tendency for many investors to apply, so the multiplier will also increase. In order to increase the odds of winning an IPO, we recommend applying from as many brokerage accounts as possible.

Frequently Asked Questions (Q&A) Regarding Opening Securities Accounts and Risks

Understanding Risks and Appropriate Countermeasures When Opening an Online Securities Account

Securities Online trading has become common and convenient, but on the other hand, there are various risks.

Opening a brokerage account and depositing funds and financial assets involves risks. However, risks associated with financial assets are not limited to securities accounts, but also bank accounts, credit cards, electronic money, and so on.

In addition, it is common to trade online securities from a computer or smartphone, so IT security measures are also essential.

Let's use convenient services with peace of mind by understanding the risks and countermeasures involved when trading online securities and dealing with them appropriately.

| Related articles |

|---|

| ・[Must-see for beginners] 10 recommended securities companies! Thorough explanation from basic information to recommended points ・10 securities accounts recommended for opening a Tsumitate NISA account! How to choose an account is also explained ・[Recommended for what kind of person? ] Thorough comparison of the features of popular Internet securities, Rakuten Securities and SBI Securities!・What is the biggest disadvantage of NISA? A thorough explanation of the points you need to know to avoid failure!・[By type] What are the recommended ETF stocks? Introducing features, benefits, and securities companies that can be purchased |

notebook-laptop

notebook-laptop