Samsung is Samsung, the top of the small and medium -sized FPD panel in 2020, BoE

Hiroshi Hayase, an OMDIA small and medium -sized FPD main analyst, was held in the 41st Display Industry Forum hosted by the British OMDIA, which was held in a virtual on -demand format until the end of August 2021We explained recent trends.

Small and medium -sized panels that increased shipments due to sanctions on Huawei

Even after the change of government in the United States, he has been vigilant against China, which is involved in security, and has been strictly regulated by Huawei, which is subject to sanctions.As a result, the production of Huawei mobile phones has been reduced, and the shipment of smartphones (smartphones) for Huawei after the third quarter of 2020 has been rapidly shrinking.On the other hand, in order to capture customers who lose Huawei, the Chinese smartphores such as the Android camp's Korean Samsung, middle OPPO, middle Vivo, and middle Xiaomi will increase inventory to expand sales to "Post Huawei".I've been procuring FPD.

As a result, the number of FPDs for smartphones in the first quarter of 2021 was unusual, exceeding the fourth quarter of 2020, despite the end of the year and after the end of the year.However, it is necessary to pay attention to what adjustments for smartphone FPDs, which are concerned about the aggressive procurement of FPD, are applied in the short term.

On the other hand, although the expansion of the new colon virus infection has not yet been converged on a global scale, in European and American countries and China, which have been suppressed by behavioral restrictions and vaccinations, economic activity restrictions are increasing.be.As a result, FPD demand for various applications that anticipates consumption of "postcolona" is expected.

Expect to increase demand in postcolona

Due to these "post Huawei" and "postcolona", the 2021 small and medium -sized FPD market is expected to grow more than 2020 in both shipments and shipments.

Meanwhile, AMOLED (organic EL), which is expanding its recruitment by Apple and Chinese smartphone, is expected to grow high, and the shipment volume of in -vehicle monitors in the automotive market that has rapidly recovered to recover from 2020 stagnation has increased.It is expected that the shipment amount of A-Si TFT-LCD will be raised.

From 2020 to 200 years, LTPS TFT-LCD has been expanding to the VR market as a new application demand.However, as smartphone makers are increasing cell procurement due to the cost reduction of FPD, the shipments of the added value of the added value are expected to be greatly reduced.

Pay attention to the growth of flexible Amored after 2022

With the expansion of 5G services since 2022, which is the "postcolona", it is expected that flexible Amored, which has been adopted in high -performance high -end smartphones, will increase shipments and support the shipment amount for smartphone FPDs.In -vehicle monitors have been revised upwards on the "center stack display (Instruments Panel with Navi and Air Conditions)" in the world of EVs, which are advanced throughout the world.

The prediction of the small and medium -sized FPD market based on these market environments does not fluctuate significantly to the conventional predictions, but in the long term, the prediction data has been updated with a slightly higher shipment.。Although the small and medium -sized FPD market in 2021 generally has a lot of rotation materials, it is necessary to pay attention to the supply and demand environment at the end of this year, including concerns about stock adjustments for smartphone FPD.

In addition, how the transmission status of the new Corona after 2022 changes throughout the world is still large, and the small and medium -sized FPD market such as smartphones and in -vehicle markets, which have a significant demand for business sentiment.Care must be taken in the surrounding environment.

The top of the small and medium -sized panel shipment in 2020 is Samsung

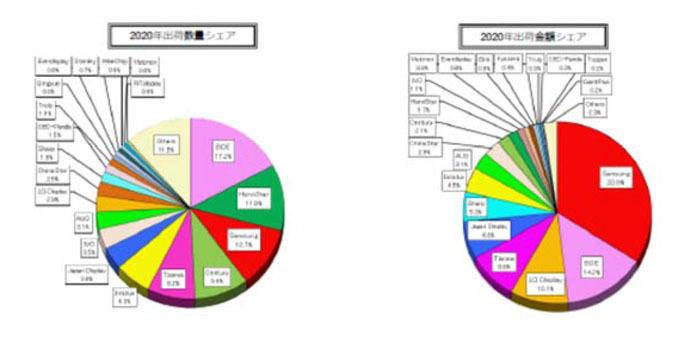

FIG. 1 shows the 2020 small and medium-sized FPD (TFT-LCD and OLED) manufacturer share by shipment and shipments.On the price basis, Samsung, a world leader in OLED, is 34 % at 34 %, the second place is 14 %, and LG DISPLAY ranks 3rd at 10 %.On the other hand, on the quantity basis, BoE is 1st (17 %) and Taiwan's Hannstar is 12 %, and Samsung (11 %) is third.

For TFT-LCD manufacturers, the first place on the shipment basis was BOE (19.5 % share), the second place was medium TianMa (16 %), and the third place was Japan display (JDI, 12 %).In the shipment basis, it is 1st place BOE (20 %), 2nd place Hannstar (15 %), and 3rd place Century (12 %).

notebook-laptop

notebook-laptop